Medicare Part D helps you pay for prescription drugs. It’s not automatic. You pick a plan, pay a monthly premium, and the plan helps cover your medicines. Part D is run by private insurance companies that work with Medicare. Each company sets its own plan details, which drugs it covers, how much you pay, and what your deductible is.

Medicare Part D plans are offered by private insurers approved by Medicare. Each company sets its own pricing and list of covered drugs, so comparing plans before you enroll is essential.

The goal is simple is to keep drug costs under control for people who need them most. Prime Life Financial helps you compare these plans, explain the rules, and avoid paying more than you should.

Understanding Medicare Part D

Medicare Part D is the prescription drug coverage under Medicare. You can add it to Original Medicare or get it through a Medicare Advantage plan that includes drug benefits.

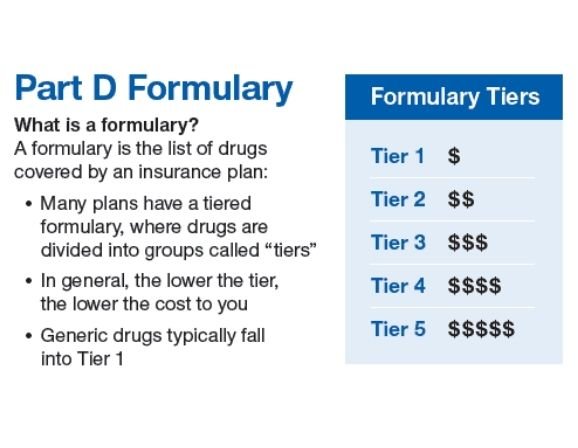

Every plan has a Medicare Part D formulary, a list of drugs it covers. Each drug is sorted into tiers that decide how much you pay at the pharmacy.

- Tier 1 drugs are usually low-cost generics.

- Tier 5 may be brand-name specialty medicines with higher prices.

Your cost depends on the tier and the pharmacy you use. Preferred pharmacies often charge less.

How Medicare Part D Works

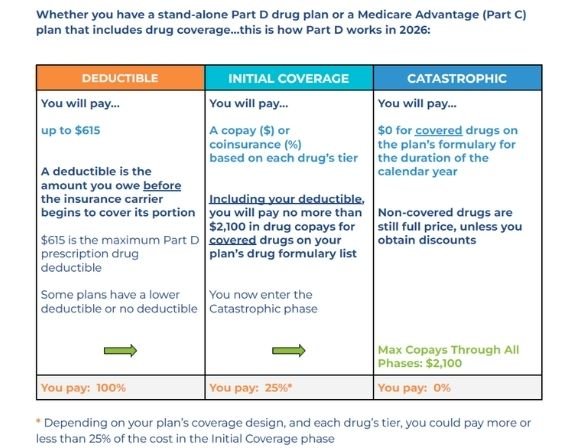

Every plan follows four basic stages. Think of it as a path from full cost to almost no cost.

- Deductible stage: You pay the full price of your prescriptions until you meet the plan’s deductible.

- Initial coverage: After that, you and your plan share the cost.

- Coverage gap (“donut hole”): Once you and your plan spend a set amount, you enter a temporary gap where you pay a higher share.

- Catastrophic coverage: When your out-of-pocket costs hit the limit, your share drops to a small copay for the rest of the year.

This cycle resets each January.

Who Can Get Medicare Part D

Anyone with Medicare Part A or Part B can join a Medicare Part D plan. You just need to live in a plan’s service area. If you have Original Medicare, you add a stand-alone prescription drug plan (PDP). If you choose a Medicare Advantage plan that includes drug coverage, that counts too.

Enrollment Deadlines

The Medicare Part D enrollment deadlines matter. Missing them means penalties that never go away.

- Initial Enrollment Period: Starts three months before your 65th birthday and ends three months after.

- Annual Enrollment Period: October 15 to December 7 every year.

You can join, change, or drop a plan. - Special Enrollment Period: Happens if you move, lose other coverage, or face special situations.

Enroll on time and you won’t face extra charges later.

What Medicare Part D Covers

Every plan covers a mix of generic and brand-name drugs. Medicare makes sure that plans cover drugs for common conditions like diabetes, heart disease, and arthritis. Plans must cover at least two drugs in each major therapy category. That way, you and your doctor have options.

What It Does Not Cover

Medicare Part D does not cover everything. These items are excluded:

- Over-the-counter medicines

- Weight-loss or fertility drugs

- Cosmetic treatments

- Vitamins and minerals that aren’t prescribed for a medical need

If your drug isn’t listed, your doctor can ask for an exception or switch to a similar covered option.

What Medicare Part D Costs

Medicare Part D premiums and costs depend on where you live and which plan you pick. You pay a monthly premium plus deductibles and copays.

Monthly Premiums

Each plan sets its own premium. In 2025, the national average is around $34 a month. High-income earners also pay an extra amount called IRMAA (the Income-Related Monthly Adjustment Amount). If money is tight, you might qualify for Extra Help, a federal program that reduces your Part D costs.

Deductibles and Copayments

Each plan can set a deductible, but Medicare sets a limit every year. For 2025, it’s $545. After you meet that amount, you and your plan share drug costs. Copays are fixed dollar amounts. Coinsurance is a percentage of the price. Both depend on your drug tier.

The Coverage Gap

Once you and your plan spend a certain amount on drugs (about $5,030 in 2025), you hit the coverage gap or “donut hole.” Here, you pay 25 percent of the cost for both brand-name and generic drugs. When your out-of-pocket costs reach roughly $8,000, you enter catastrophic coverage, and your share drops again.

Medicare PDP vs Medicare Advantage Drug Coverage

You can get prescription coverage in two ways: through a stand-alone Medicare PDP or a Medicare Advantage plan with drug benefits.

Stand-Alone PDP

This plan works with Original Medicare. You keep your doctor and hospital coverage and add Part D just for drugs. It’s flexible and fits people who like choosing their own providers.

Medicare Advantage Plans with Drug Coverage

These plans bundle everything, hospital, medical, and drug coverage into one. They often have lower premiums but smaller doctor networks. If you want simple billing and one card, this is an option. Prime Life Financial can compare both for you and show where you save the most based on your medicines and pharmacy choices.

How to Choose a Medicare Part D Plan

The best plan is the one that fits your prescriptions, your budget, and your routine.

What to Check Before You Enroll

- Are your drugs on the plan’s formulary?

- Does your pharmacy offer preferred pricing?

- What’s the monthly premium?

- How high is the deductible?

- Are mail-order options cheaper?

Prime Life Financial reviews these points side by side so you don’t miss hidden costs or coverage limits.

| Enroll in Your Medicare Part D Plan Before the December 7 Deadline Prime Life Financial helps you compare Part D plans and enroll before the season ends. Act now to save. Enroll Now |

Medicare Part D Enrollment Deadlines and Penalties

Miss an enrollment deadline, and you’ll face a penalty that sticks for life.

The Late Enrollment Penalty

If you go 63 days or more without creditable drug coverage, Medicare adds a penalty to your premium. It’s 1 percent of the national base premium for each month you wait. Delay 12 months? You pay 12 percent extra, forever. Prime Life Financial keeps track of these dates so you don’t get stuck paying extra later.

Ways to Save on Medicare Part D

Prescription drugs can be costly, but you have options to cut that bill.

Simple Ways to Spend Less

- Choose generic drugs whenever possible.

- Use preferred pharmacies for lower copays.

- Ask about mail-order discounts.

- Apply for Extra Help if your income qualifies.

- Review your plan each year to catch changes in drug lists and costs.

Some people compare Medicare Part D vs drug discount cards to see which saves more. Discount cards can lower prescription prices, but don’t offer full insurance coverage. Medicare Part D gives structured coverage, limits yearly costs, and counts toward out-of-pocket totals, something discount cards don’t do. Prime Life Financial helps you spot savings before you enroll and each renewal season.

| Lock In Lower Prescription Costs Before Enrollment Closes Prime Life Financial reviews plans side by side to cut your drug costs this Medicare season. Contact Now |

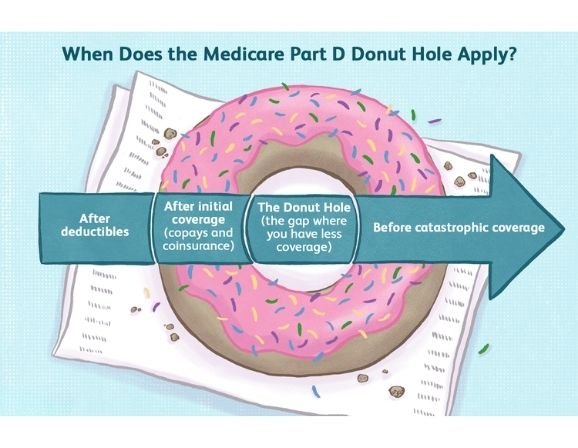

Understanding the Coverage Gap (“Donut Hole”)

The donut hole is the middle stage of Medicare Part D. It starts after you and your plan spend a set amount on drugs. During this phase, you pay about a quarter of each drug’s cost. You stay in the gap until you hit the catastrophic limit. Then your share drops again for the rest of the year. The Medicare Part D donut hole begins after you and your plan spend a certain amount on prescriptions. During this stage, you pay about 25% of drug costs until you reach the catastrophic coverage threshold.

This system keeps drug prices somewhat balanced but can still surprise people new to Medicare. That’s why Prime Life Financial reviews your annual spending and helps you plan for it early.

How the Medicare Part D Donut Hole Works

The coverage gap, also called the donut hole, comes after your first coverage stage. You reach it when total drug spending hits the yearly limit. For 2025, that’s around $5,030. Inside the gap, you pay about 25 percent of your drug costs. That applies to both brand-name and generic drugs. You stay in this phase until your own out-of-pocket spending hits the next limit, about $8,000.

Once that happens, you move into catastrophic coverage. Your share of drug costs drops fast, and your plan starts paying most of the bill. You’ll only owe a small copay or coinsurance for the rest of the year. Prime Life Financial helps you plan for this stage so you’re never caught off guard.

Catastrophic Coverage Explained

Catastrophic coverage is the safety net built into Medicare Part D. It begins after you’ve paid enough out of pocket in the donut hole. In this stage, your share becomes very small, usually 5 percent or a small fixed amount.

That protection keeps long-term medicine costs from overwhelming your budget. It resets each January, so the cycle starts fresh every year.

Common Questions About Part D Costs

Why do some drugs cost more than others?

Every plan sorts drugs into pricing tiers. Low-tier generics cost less; high-tier brand or specialty drugs cost more. Plans also cut deals with drug makers and pharmacies, which can change your price.

Can you have two Part D plans at once?

No. You can only be in one Medicare Part D plan at a time. If you sign up for a new one, your old plan ends automatically.

What if you already have drug coverage from work?

If your job or union plan offers creditable coverage, you can delay enrolling in Medicare Part D without penalty. You’ll need written proof that your current coverage is equal to or better than Part D. Many people compare Medicare Part D vs employer coverage when retiring. If your job plan offers equal or better prescription coverage, you can delay enrolling in Part D without penalties.

How Prime Life Financial Helps You Choose

Comparing drug plans takes time. Each plan has its own list of medicines, pharmacy network, and cost rules. Prime Life Financial does that homework for you. They look at your prescriptions, preferred pharmacies, and budget. Then they match you with plans that save you the most money.

Their licensed advisors help with:

- Checking which plans cover your medicines

- Tracking enrollment deadlines

- Applying for Extra Help if you qualify

- Reviewing your plan every year before renewal

You get clear options, honest advice, and no pushy sales talk.

Key Points to Remember

- Medicare Part D helps cover prescription drug costs.

- Plans differ in price and drug lists, so compare before enrolling.

- Missing deadlines means paying lifelong penalties.

- The donut hole still exists, but now limits what you pay.

- Prime Life Financial can guide you through every step.

Medicare Part D can look complicated, but once you understand the stages, it’s easier to manage. It protects your health and your wallet.

| Find Your Medicare Part D Plan Before Enrollment Ends Compare plans, premiums, and coverage with Prime Life Financial before Dec 7. Don’t miss your chance to save on prescriptions. Get Started |

Final Thoughts

Medicare Part D keeps prescription costs manageable. It’s built to share the load between you, your plan, and Medicare. You choose a plan, pay a monthly fee, and in return get steady help with drug costs all year.

Knowing how the stages work from deductible to donut hole to catastrophic coverage helps you plan ahead and avoid surprises. The best move is to compare plans early, enroll on time, and review your coverage every year.

Prime Life Financial makes that process simple. They help you find a plan that fits your medicines, your income, and your peace of mind. That’s what Medicare Part D is really about, staying healthy without worrying about the next pharmacy bill.

FAQs

What are the disadvantages of Medicare Part D?

You may face higher copays if your drugs aren’t on the plan’s list, and the donut hole can raise short-term costs. Missing enrollment dates adds a penalty that never goes away.

Do you automatically get Medicare Part D?

No. You have to sign up. If you skip it at first eligibility, you’ll pay more later.

What does Medicare Part D cover for seniors?

It covers most outpatient prescription medicines for common conditions like diabetes, heart disease, and arthritis.

Is Medicare Plan D worth it?

Yes. It limits yearly drug spending and keeps long-term medication costs affordable.